Calculate pa sales tax

Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. The Pennsylvania sales tax rate is 6 percent.

How To Calculate Sales Tax In Excel

SALES AND GROSS RECEIPTS TAXES.

. To calculate the right sales tax in Pennsylvania youll need to add up the state county and city rates for your location. Cigarette tax is calculated by multiplying. The state has a flat income tax rate of 307 and a sales tax rate of 6.

The first is Allegheny County. Ad Produce critical tax reporting requirements faster and more accurately. 65 100 0065.

50 percent of the actual tax liability for the same month of the previous year or At least 50 percent of the actual tax liability for the current period new calculation method AST Level 2 -. General Sales and Gross Receipts Taxes. Calculate Sales Tax in Pennsylvania Example.

The price of the coffee maker is 70 and your state sales tax is 65. List price is 90 and tax percentage is 65. The sales tax rate for Allegheny County is 7.

The statewide base sales tax rate in Pennsylvania is 6. Just enter the five-digit zip. Sales Tax 25000 -.

Step One - Calculate Total Tax Due. 6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local. Multiply price by decimal.

54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and. The use tax rate is the same as the sales tax rate. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Pennsylvania state sales tax rate range 6080 Base state sales tax rate 6 Local rate range 020 Total rate range 6080 Due to varying local sales tax rates we strongly. Just enter the five-digit zip. Pennsylvania offers a few tax deductions and credits to reduce your tax liability including deductions for.

This is the rate charged in most places around the state with two exceptions. Divide tax percentage by 100. Ad Fast Online New Business Pennsylvania Sales Taxes.

By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. Avalara provides supported pre-built integration. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind.

Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia. Fast Processing for New Resale Certificate Applications. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that.

How to calculate Pennsylvania sales tax. There are three steps in calculating tax payments and total amounts due on cigarette and little cigar purchases. Selective Sales and Gross Receipts Taxes.

The easiest way to do this is. Get a demo today.

How To Calculate Sales Tax In Excel

Sales Tax Calculator Taxjar

How To Calculate Sales Tax In Excel

Pennsylvania Sales Tax Guide For Businesses

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pennsylvania Sales Tax Guide For Businesses

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Pennsylvania Income Tax Calculator Smartasset

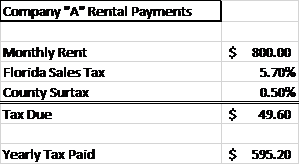

How To Calculate Fl Sales Tax On Rent

Pennsylvania Sales Tax Guide For Businesses

Reverse Sales Tax Calculator

Pennsylvania Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Calculator Taxjar

Llc Tax Calculator Definitive Small Business Tax Estimator

Pennsylvania Sales Tax Small Business Guide Truic

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Calculator Taxjar